Something to consider: Business owners who meet with their accountants monthly tend to view them as their most trusted advisors, consulting with them for business advice more often than family, friends, and even their lawyers.

Conventional wisdom says becoming a trusted advisor means offering your accounting expertise, being consultative, and sharing clear, actionable financial wisdom. Accountants say expanded service offerings (and related revenue streams) help them become a trusted advisor. But what do small business clients think? We asked 1000 small business owners how they view a trusted advisor, and they saw it in two ways:

1. Trusted advisors offer a wider range of services

2. Trusted advisors are seen as knowing their clients better

Based on our research, we made three observations about what makes an accountant a trusted advisor and how you might incorporate these into your practice.

1. Offering a wider range of services

On average, about 61 percent of small businesses are satisfied with the breadth of services that their accountant offers. But, when business owners feel their accountant is a trusted advisor, that number jumps to 88 percent. And it makes sense. The more services you offer, the more involved you are in the operational nitty-gritty and the deeper the partnership between you and your clients grows.

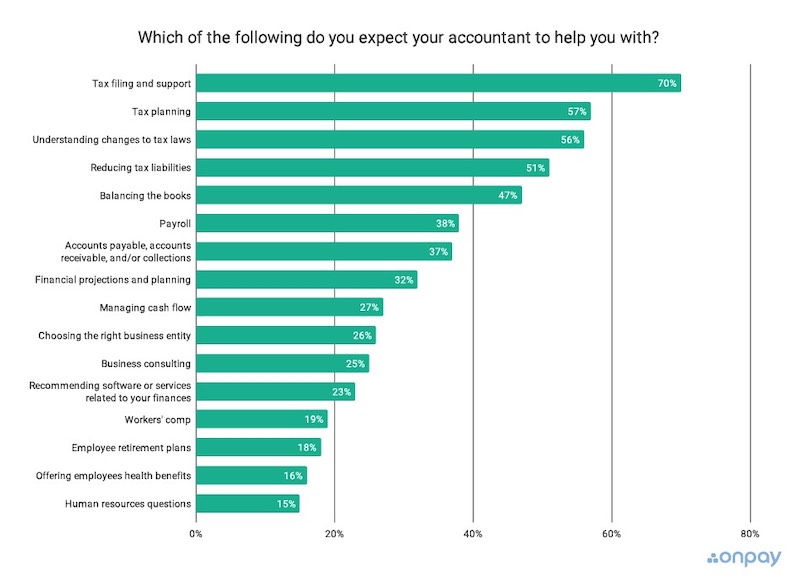

Your clients need help with the books and taxes, but many small business owners also expect their accountant to help with processing transactions and making strategic decisions. However, 25 percent of small business owners we talked to said they would like their accountant to help with other financial and advisory services such as payroll (38 percent of business owners expect their accountant to help), and accounts payable/accounts receivable (37 percent). Here’s the whole list:

Here’s something else to consider as you expand the scope of your service offerings: Our survey found that some 70 percent of small businesses don’t currently work with an accountant. Some feel the cost is prohibitive or they’re still too small for accounting services. What’s worth noting is that those small business owners who don’t yet have an accountant expect a broader range of services to be available to them when they decide to hire one (compared to those companies who already work with one).

2. Increasing communication to build your relationship

The better you know your client and their business, the higher the trust grows. We found that while half of small business owners said their accountant knows them very well — when they described their accountant as a trusted advisor, that number jumped to 84 percent.

Consistent check-ins with your clients on key aspects of their finances like cash flow and payroll expenses let you have regular conversations — and that communication turns out to be an important factor when it comes to small business owners viewing their accountant as a trusted advisor. 47% of small businesses that describe their accountant as a trusted advisor said they have contact with them once a month or more. On average, only 39% of all small business owners talk to their accountant that often.

Something to consider: Business owners who meet with their accountants monthly tend to view them as their most trusted advisors, consulting with them for business advice more often than family, friends, and even their lawyers.

3. Keeping on top of new technology trends

You probably wouldn’t be reading this blog if you weren’t interested in keeping up with smart, new accounting technology. And that cutting-edge commitment will help you build this relationship. When SMBs were asked to list their top tech priorities, payroll and accounting software came in at number two and three just behind a CRM. Could this also have something to do with the reality that small business owners spend an average of 18 or so hours each month doing payroll (and another 18 taking care of HR)?

And, in a bit of an “If you build it, they will come” scenario, there seems to be a direct correlation between businesses who view their accountants as trusted advisors and overall software adoption. Is this because their accountant suggested time and money-saving tools, or is it because everything just runs more smoothly?

What software options are small businesses using?

- Payroll (60 percent)

- Accounting (50 percent)

- Expense tracking (35 percent)

- Time tracking (31 percent)

- Benefits administration (28 percent)

- HR software (27 percent)

It’s worth noting that 96 percent of small business owners that use HR software see their accountant as a trusted advisor.

By expanding your services, building communications, and staying on top of technology, you can develop a better relationship with your clients on your way to becoming a trusted advisor.

And, as a bonus, with all this newfound collaboration and connection, you’ll be able to free them up to run their business while developing new services and revenue streams for your practice.