The homepage is the most important page of your business’s website. It is the virtual shop front to your business, providing your customers a first impression of what you have to offer. You only have seconds to grab your customer’s attention so it is key to make sure that they can find what they’re looking for quickly and easily.

Clichés. Can’t live with them, can’t live without them. (See what just happened there—it’s that bad).

The most widespread, just-waiting-to-pop-out-at-you, cliché is a very short one, measuring just three words—time is money.

Too often businesses leave collecting debts at the bottom of the pile. Why? Often there is anxiety and worry around the process, or lack of trust in collection agencies. Sometimes lack of time and understanding of the process.

Over 100 accounting/bookkeeping, marketplace and banking partners across Asia joined us in Brisbane this year to attend Xerocon, the most innovative conference for cloud leaders in Asia, Australia and New Zealand.

There’s literally hundreds of blog posts giving you the 7-10 steps to reduce debtors and improve cashflow. Yet the debtors problem still exists to some extent in the majority of small and medium size enterprises (SMEs) globally.

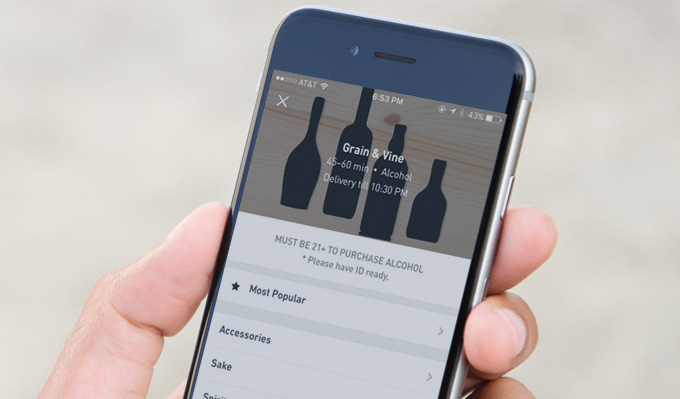

We no longer need studies to tell us: Smartphones are almost everywhere. Most of the customers coming through your doors have a mobile device with them. And these devices aren’t always shoved in pockets or bags — shoppers are using them while they’re in store too.

Offers for grants worth over $3.5 million will support 7 businesses to help launch their innovative products, processes and services into domestic and international markets.

The funding has been provided from the Accelerating Commercialisation element of the Entrepreneurs’ Programme.

Anticipating future demand is a tough job, wrought with ways you might go wrong. Proper demand forecasting and inventory control can save a company from buying too much or too little of something, which of course avoids expensive overstock scenarios or stockouts.

Tax time is fast approaching—it’s important to do your homework and know exactly what tax deductions you can claim.